Top 3 PSU Equity Funds in India

PSU is also known as Public Sector Undertakings or companies owned by the Government of India. PSU Equity Funds invests in the equity shares of the companies or banks that are owned by the Government of India.

Today in this article we have screened the Top 3 PSU Equity Funds in India based on their last 1 year returns. Since the PSU Equity fund is a sectoral category that has performed extremely well recently, we have shortlisted the top 3 funds of this category for you.

Top 3 PSU Equity Funds In Last 1 Year

Aditya Birla Sun Life PSU Equity Fund: In the last 1 Year, this fund has delivered 95.65% returns as of 01-Mar-2024 and is currently the top fund of our PSU Equity Fund list. This means the Investment of ₹1,00,000 done on 01 Mar 2023 would have been ₹1,95,650 as on 01 Mar 2024.

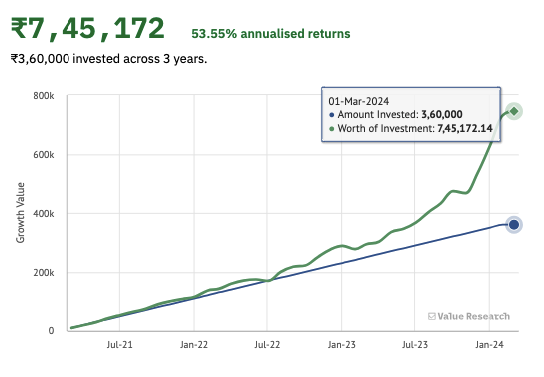

And a monthly SIP of ₹10, 000 started 3 Years ago Aditya Birla Sun Life PSU Equity Fund would have been worth ₹7,45,172 as of 01-Mar-2024 delivering 53.55% annualized returns on investment across 3 years of ₹3, 60,000.

Aditya Birla Sun Life PSU Equity Fund is currently investing majorly in Large and Midcap Companies of Energy (36.54%), Financial (27.68%), and Capital Goods (9.67%) Sectors of Government Companies. This fund is currently managed by Fund Manager Mr. Dhaval Gala since 22 Sep 2022.

SBI PSU Fund: In the last 1 Year, this fund has delivered 92.42% returns as of 01-Mar-2024 and is currently the 2nd fund of our PSU Equity Fund list. This means the Investment of ₹1,00,000 done on 01 Mar 2023 would have been ₹1,92,420 as on 01 Mar 2024.

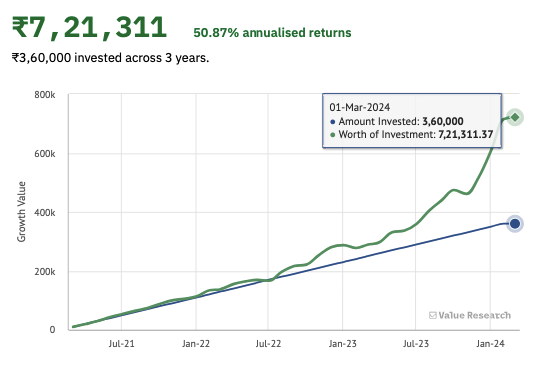

And a monthly SIP of ₹10, 000 started 3 Years ago SBI PSU Fund would have been worth ₹7,45,172 as of 01-Mar-2024 delivering 53.55% annualized returns on investment across 3 years of ₹3, 60,000.

SBI PSU Fund is currently investing majorly in Large and Midcap Companies of Financial (42.10%), Energy (21.96%), and Capital Goods (14.33%) Sectors of Government Companies. This fund is currently managed by Fund Manager Mr. Richard D’souza since 01 Aug 2014.

Invesco India PSU Equity Fund: In the last 1 Year, this fund has delivered 88.47% returns as of 01-Mar-2024 and is currently the 3rd fund of our PSU Equity Fund list. This means the Investment of ₹1,00,000 done on 01 Mar 2023 would have been ₹1,88,470 as on 01 Mar 2024.

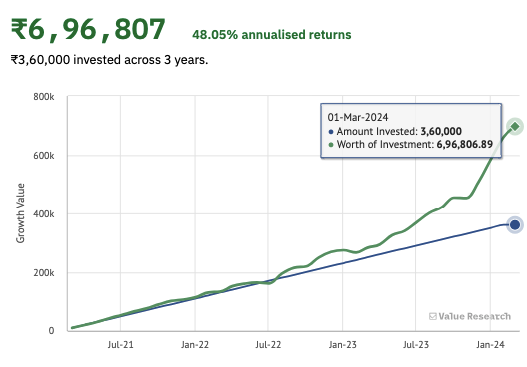

And a monthly SIP of ₹10, 000 started 3 Years ago Invesco India PSU Equity Fund would have been worth ₹6,96,807 as of 01-Mar-2024 delivering 48.05% annualized returns on investment across 3 years of ₹3, 60,000.

Invesco India PSU Equity Fund is currently investing majorly in Large and Midcap Companies of Energy (38.31%), Capital Goods (21.60%), and Financials (20.14%) Sectors of Government Companies. This fund is currently managed by Fund Manager Mr. Dhimant Kothari since 19 May 2020.

* * *

If you like this post, please do share it with others, and also Subscribe to My YouTube Channel.

Disclaimer: Mutual Fund Investments are subject to market risk, read all scheme-related documents carefully before investing. Past Performance may or may not sustain in the future. The above mentioned data is as on 02 Mar 2024 using the data source of Regular Plans from Value Research Online & Internet for educational purposes only. Kindly Consult to know your suitability before Investing. Gurpreet Singh Saluja is an AMFI Registered Mutual Fund Distributor.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.