What are Derivatives?

Derivatives

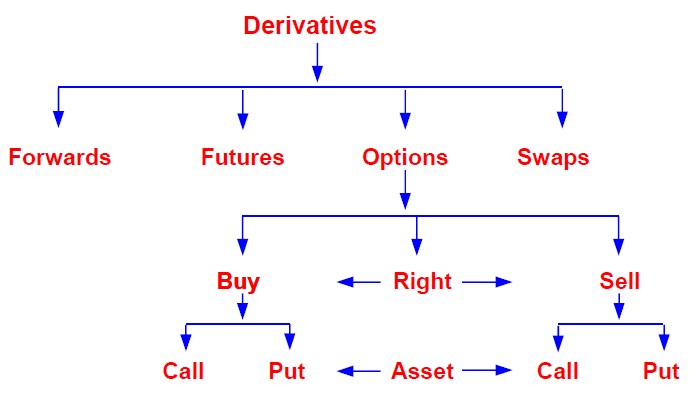

Derivatives are defined as financial instruments whose values are derived from the prices of underlying assets such as equity shares, commodity, interest rates, Foreign Exchange (FOREX) etc.

Derivatives can also be defined as a financial instrument that does not constitute ownership, but promises to convey ownership.

Examples: Futures and Options

The Term Derivative has been defined in Securities Contracts (Regulations) Act, as:-

A Derivative includes: –

- A security derived from a debt instrument, share, loan, whether secured or unsecured risk instrument or contract for differences or any other form of security.

- A contract which derives its value from the prices, or index of prices of underlying securities.

Derivatives can be used for:

- Hedging

- Speculation

- Arbitrage

Derivatives products are contracts, which have been constructed based on any of the underlying asset. Futures and options are commonly avaliable in the following assets:

- Commodities

- Equity Shares, Stock Market Index

- Currency

Let’s make it more clear to you with the following illustration:

Mr. A buys a futures contract of “Reliance Industries”. The Profit or loss on this contract will depend on the price movement of Reliance shares in cash segment, as the price of a future contract is related to the price of the underlying asset.

He will make a profit of Rs. 500 if the price of Reliance Industries rises by Rs. 500. If the price remains unchanged Mr. A will receive nothing. If he stock price of Reliance Industries Falls by Rs 750, he will lose Rs. 750.

Thus the contract depends upon the price of the Reliance Industries scrip which the underlying security.

____ X ____

If you have any query then tweet @gurpreet_saluja or Fill This Form.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.