Inflation is REAL, Don’t IGNORE it.

Inflation is an invisible tax applied to the general public, most of us think it doesn’t exist and ignore it and most of us know about it and they still ignore it.

Page Contents

What Is Inflation?

Inflation is losing the purchasing power of your money over the years, say you had monthly expenses 10 years ago of Rs.50,000 that have now become Rs.98,838 if you maintained the same standard of living.

The prices of basic grocery items like Wheat, Milk, and Vegetables have increased significantly over the years – this is inflation. On average in India as per RBI data Retail inflation is increasing at 7% per annum.

Do You Know?

Today, if your monthly household expenses are Rs.1,00,000 (One Lakhs) then in the next 30 years that will increase to Rs.5,74,348 (5.74 Lakhs) per month.

And if you retire after 30 Years with No Active Income how will you manage these expenses? They will still keep on rising every year. (This is inflation, it’s not visible, but it is there – accept it or not.)

With these Expenses, If you LIVE another 25 Years with NO Active Income, you need a corpus of approx Rs.13.77 Crores.

How are you going to accumulate that Rs.13.77 Crores in those 30 Years while you are earning?

This is just one example of retirement costs, inflation applies to the education costs of your children’s too. An MBBS degree or an MBA degree cost has increased 2.5x in the last 10 years.

If you plan today’s cost of education say Rs. 25 Lakhs and target it to achieve in the next 10 years, then that cost will rise to approx Rs. 62.5 Lakhs then how will you accumulate the difference of Rs. 37.5 Lakhs which is the result of inflation?

Right Asset Class

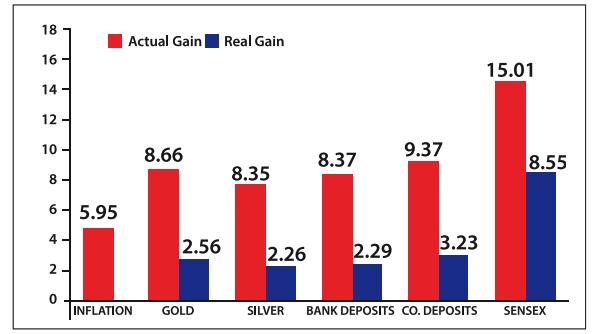

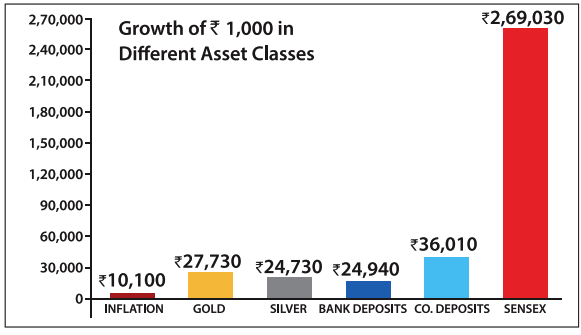

Achieve your goals by investing in the right asset class that has consistently delivered inflation-adjusted returns for decades, here’s a snapshot of returns of different asset classes.

As you can see Equity has Outperformed all other Asset Classes in the Long Term.

Also, Equity Mutual Fund Provides you tax-efficient returns in the long term and inflation-adjusted positive real returns.

Conclusion

Inflation is Real, Don’t Ignore It – You may say, I will manage it when the time comes but, in reality, many fail to manage when actual times come – Don’t fall prey to luck and time, always plan your financial goals in time and start accumulating your wealth in right asset classes – the best is doing regular monthly SIPs in Equity Mutual Funds.

CLICK HERE TO START YOUR SIP IN EQUITY MUTUAL FUNDS WITH US.

Disclaimer: Mutual Fund Investments are subject to market risk, read all scheme-related documents carefully before investing. Gurpreet Singh Saluja is an AMFI Registered Mutual Fund Distributor (ARN-107627)

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.