ITC Limited: Segment Wise Turnover & Revenue

As most of the investors are looking to invest in this company but before investing they want to dig a little deep about its segment-wise reports to understand more about this company.

Pulling out a few details from the company’s latest annual report on segment-wise turnover & sales for your reference & benefit.

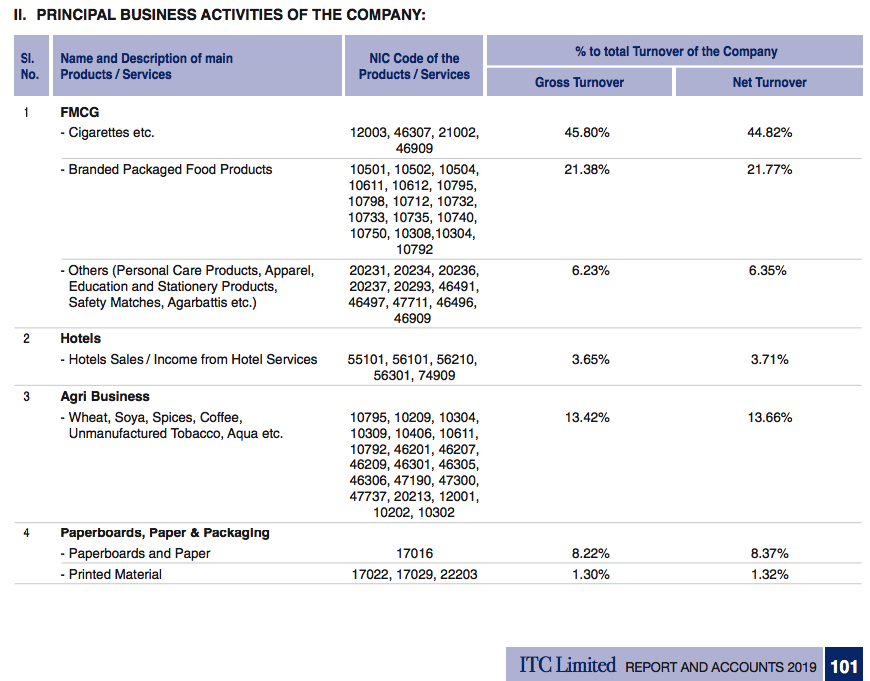

SEGMENT WISE TURNOVER FOR ITC LIMITED

As per the company’s annual report 2019, the FMCG Segment had a Gross turnover of about 73.41% of total turnover in which the Cigarettes were at 45.80%, Branded Packaged Food Products at 21.38%, Personal Care/Apparels/Stationary, etc at 6.23%

Whereas, Hotel Business is only about 3.65% as most people were thinking that due to current lockdown the hotel industry is not doing well and as ITC is involved in Hotels too so it will impact but the overall impact due to this is only around 3.65%.

Gross Turnover of Agri-Business is about 13.42% & Paperboards, Paper & Packaging is at 9.52%.

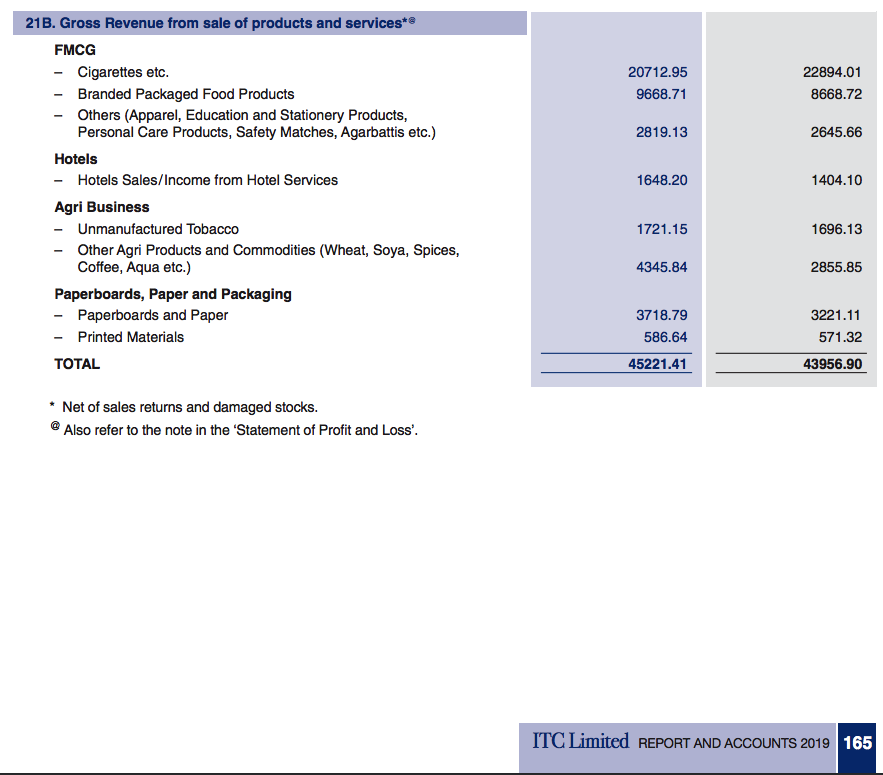

SEGMENT WISE GROSS REVENUE FOR ITC LIMITED

As per the latest annual report of ITC Limited, the Total Gross Revenue was INR 45,221.41 Crores.

Of which the Gross Revenue from FMCG Segment as a whole was about INR 33,200.79 Crores. Gross Revenue from Cigarettes was INR 20,712.95 Crores, Branded Packaged Food Products was INR 9,668.71 Crores & from Personal Care/Apparels/Stationary, etc was at INR 2,819.13 Crores.

Hotel Sales & Income from Hotel Services was INR 1,648.20 Crores.

Gross Revenue from Agri-Business was INR 6,066.99 Crores & Paperboards, Paper & Packaging was at INR 4,305.43 Crores.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.