Power of Regular Investments

We are earning money and want to create wealth for our future financial obligations, but most of us are not regular with our investments, today I would like to share with you the Power of Regular Investments in Equity Mutual Funds.

Equity Mutual Funds have been consistently creating wealth for those who are positive about the Indian Economy and stay in the course of wealth creation.

In many cases, investors don’t tend to regularly invest in it and as a result, they are not able to generate wealth for themselves.

Case Study

Let’s understand this better with the example of Mr. Nikhil who got to know about Equity Mutual Funds in 2006 and decided to start 3 SIPs of Rs.10,000 each.

Let’s go back to Nov 2006 – that’s 15 years back when he started SIP in 3 different Diversified Equity Funds.

In Nov 2006, he started SIP with a time horizon of 5 years only because he was new to Equity Mutual Funds and he wanted to make a start with 5 year period.

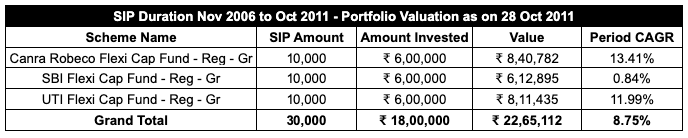

Nov 2006 to Nov 2011 (5 Year)

In Nov 2011 when his SIP’s completed tenure of 60 months he reviewed his portfolio, it was like this.

His investments of Rs.18 Lakhs were worth Rs.22.65 Lakhs as of 28 Oct 2011.

So, In Nov 2011 when Nikhil reviewed his portfolio, he saw 2 funds are performing well, but the SBI Flexi Cap fund barely gave him any return, he discussed this with his friend who suggested to continue investing for another 5 years.

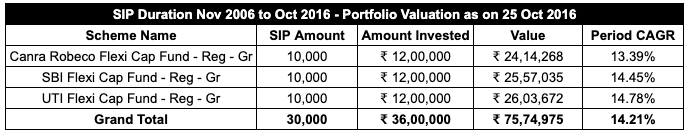

Nikhil listened to his friend and continued his SIP for another 5 years, when in Nov 2016 he reviewed his Portfolio – he was shocked to see the turnaround in the fund that barely performed, this is how his portfolio looked in 2016.

Nov 2006 to Nov 2016 (10 Year)

Now, his total investment was Rs.36 Lakhs which grew to Rs.75.74 Lakhs as of 25 Oct 2016.

Seeing the good performance his SIP investments were generating and creating wealth for him, he decided to continue his SIP for another 5 years.

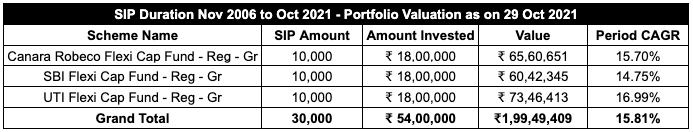

Nov 2006 to Nov 2021 (15 Year)

He didn’t expect that his investment of Rs.54 Lakhs that he invested as Rs.30,000 per month would grow to Rs.2 Crores compounded at 15.81% for the last 15 years.

As you can see, regular investments in equity mutual funds are the key to generating wealth at decent returns over long periods.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.