SIP In Rising or Falling Market?

Systematic Investment Plan in Mutual Funds or SIP in Rising or Falling Market – which one you should prefer?

Many retail investors prefer to continue their SIPs in Equity Mutual Funds when the markets are rising and to stop their SIPs when markets are falling.

Is this the right way to invest? Let’s discuss this with an illustrative example that will help you understand the right way of investing.

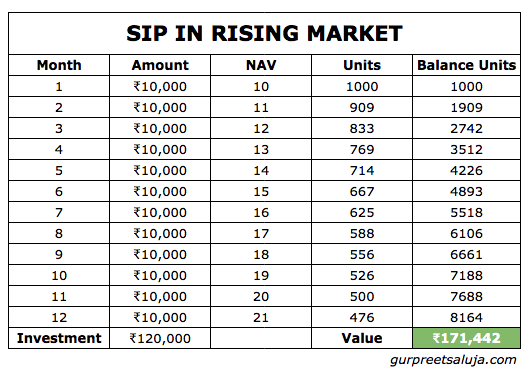

SIP In Rising Markets

An investor started SIP of Rs.10,000, after starting his SIP with the increase in positive outcomes, the markets started rising, so he continued his SIP for the next 12 months.

During the bullish phase where the market almost doubled his SIP looks something like this…

In a rising market where the investor never saw portfolio negative, in fact, the markets doubled in 12 months so the NAVs of the fund, the SIP investment of Rs.1,20,000 resulted in the value of Rs.1,71,442.

As per the above illustration he accumulated 8164 units in 12 months with NAV of Rs.21 that resulted in Rs.1,71,442

Now let’s see what happens to the SIP Investments in Falling Markets.

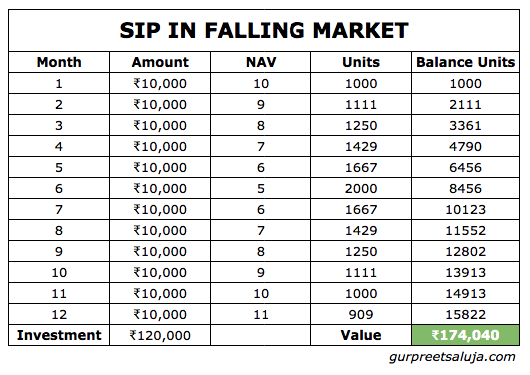

SIP In Falling Markets

Similarly, another investor started SIP of Rs.10,000, after starting SIP the global pandemic news started flowing and markets started falling significantly and later on recovered to its previous levels, this is how the SIP Investment looks like…

In this case, where an investor started SIP and then the market started falling, it almost fell 50%, and then later it recovered to its previous levels.

As we all know in long run markets move in a single direction that is bullish, the market falls are temporary corrections only.

In long run markets move in a single direction that is bullish. Click To TweetThe above illustration clearly states that during the falling market the SIP Investment accumulated more units which resulted in the value of Rs.1,74,040 at the same investment of Rs.1,20,000

So this clearly states that SIP Investment in falling markets is more beneficial for long term investors.

The best part of SIP investment is that it provides you the benefit of rupee cost average along with the discipline which results in the long term compounding of your wealth.

Increase your SIP in Falling Markets to double the impact of compounding your wealth.

* * *

If you like this post, please do share it with others, and also Subscribe to my weekly newsletter below.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.