Stop Eroding Your Wealth

We are eroding most of our wealth without even knowing it, in this blog we will discuss some insights about the returns you get from fixed deposits and how you can stop eroding your wealth.

Page Contents

The Reality of Returns From Bank FD

Currently in India, Returns on Bank FD’s are around 5.5% per annum.

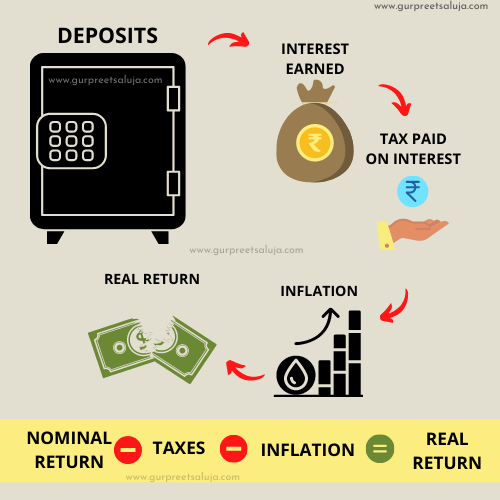

A Resident Indian falling under the highest Income Tax Bracket has to pay 30% tax on this 5.5% means his Post-Tax nominal return from Bank FD will be 3.85% per annum.

Inflation is around 5% per annum means we are losing the value of our money by 5% every year.

So, now if Post Tax Nominal Return from Bank FD is around 3.85%, then considering the inflation of 5% the real-return a high tax bracket resident gets is -1.15% (Yes, NEGATIVE 1.15%).

As the bank FD returns are Guaranteed, Inflation is also guaranteed. However, we have taken a conservative figure of 5% only. But In reality, we all know that inflation numbers are higher than this.

So, this means that there is “Guaranteed Negative Return” that every Depositor receives.

How Much Wealth Is Being Eroded Every Year?

I was going through Deposits data on the RBI website which shows that there are around ₹128.45 Lakh Crores worth of Deposits in Scheduled Commercial Banks.

This means that every year around ₹1.47 Lakh Crores of Wealth is being eroded (@ -1.15%).

How To Stop Eroding Your Wealth?

Only 5% of People in India have knowledge about this fact and they have considered moving to other investment avenues like Mutual Funds.

With negative real returns, nobody want’s to continue eroding their wealth.

But what you should do at this point? You may not be comfortable taking risks or you want guaranteed returns which a mutual fund doesn’t provide.

Well, in this case, I would suggest to re-think because in the name of GUARANTEE there’s no sense to get Negative real returns.

For positive real returns, tax-efficient returns, and inflation-beating returns, one has to participate in equity mutual funds.

Because only equities have the potential to give you tax-efficient & inflation-beating returns, in the long run, say 5 years, 10 years, or even more.

Stop eroding your wealth every year, It’s time to think about this and move to better investment options where you can beat inflation post taxes.

And, If you are looking for Professional help To Start Investing in Mutual Funds, Click: gurpreetsaluja.com/invest

* * *

If you like this post, please do share it with others, and also Click here to Subscribe to my FREE Email Newsletter.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.