Basic Investment Styles

There are different types of basic investment styles in the market, You might have heard them from Experts on Business Channels using the terms of these investment styles.

Let’s discuss about the different basic investment styles..

Basic Investment Styles

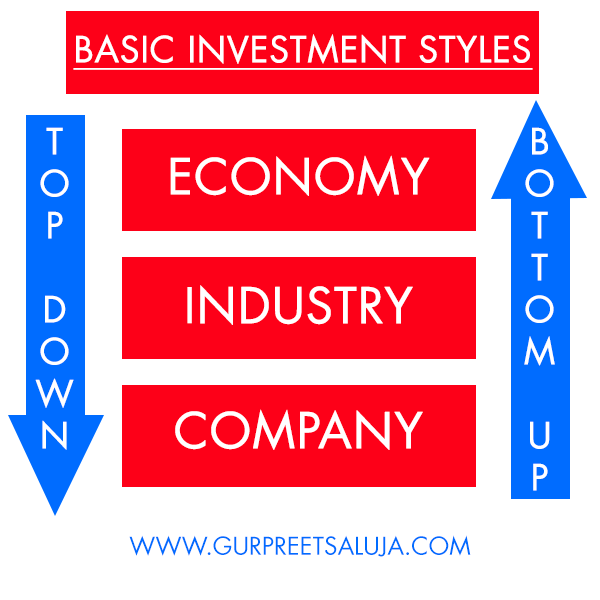

1. Top Down & Bottom Up Investing

Top Down Investing is an Investment approach in which the research for an investment decision takes place firstly at Macro Level like Economy, E.g: High Growth. Secondly they look at Industry level and then at last they look at Company Level.

After analyzing in this pattern they take their investment decisions. This kind of investment style is known as Top Down Investing.

Bottom Up Investing is an Investment approach in which the research for an investment decision takes place firstly at Company Level, Secondly at Industry Level and then at last at Macro Level. This kind of investment style is known as Bottom Up Investing.

2. Fundamental & Technical Analysis Investment Styles

Fundamental Analysis is the process of analyzing financial data of the company.

- Takes only variables that are directly related to the company.

Technical Analysis means forecasting future price movements based on examination of past price data. It is said that what everyone wants to know about the company is factored in the price.

3. Growth Investing & Value Investing Styles

Growth Investing Investment Style is a style in which an Investor looks at the following factors of the company like High Growth Rate, High Price to Earnings (P/E) and Low Dividend Yield.

Value Investing Investment Styles is a style in which an Investor looks at Low Market to Book Value of Company, Low Price to Cash or Price to Earnings (P/E) ratio and High Dividend Yield.

Learn About Other Financial Terminologies:

____ X ____

If you have any query then tweet @gurpreet_saluja or Fill This Form.

Hi, I’m Managing Director at Gurpreet Saluja Financial Services where I help my investors to invest in mutual funds and achieve their financial goals. I’m also a Value Investor and here I write about Personal Finance & Investing.

Start Your SIP in Mutual Funds.

Start Your SIP in Mutual Funds.